Here are some things you should know about the Oil & Gas Investment Programs offered by our affiliates:

View the video above to learn more about modern horizontal drilling technology and how it works!

Every investment has risks. Click here for information about the risks associated with this type of investment opportunity.

The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities; the investment is highly illiquid. Investing in securities involves risk. Investors should be able to bear the potential loss of their entire investment.

Why you should take advantage of oil & gas investment opportunities:

Oil & Gas Supply and Demand:

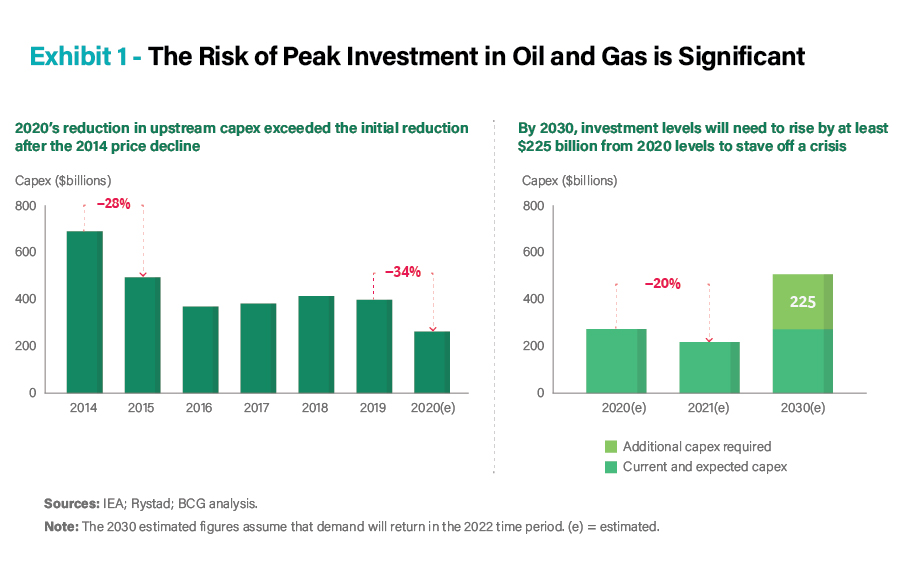

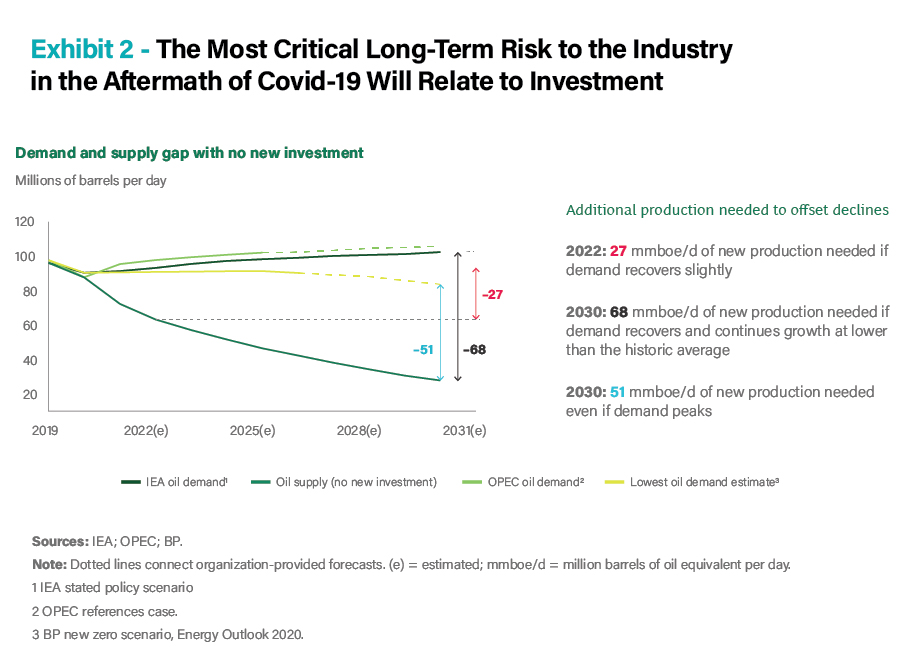

A joint study by the International Energy Forum and Boston Consulting Group highlights the need for future oil and gas investments with the following quote:

“Lower [investment] levels appear to be insufficient to deliver the volumes of oil and gas needed to maintain market stability…Even if oil demand were to flatten, the industry would still need to make significant investments to compensate for production declines (natural oil and gas production decreases over the life of a well as the deposit it taps is depleted).”

Below are two exhibits from the report showing the risk of peak investment and risk to demand and supply: